I love fundamental theories in positive sciences like the Darwinian Evolution Theory, Game Theory, or Fourier’s Frequency Transformation. Once you have a solid understanding of such fundamental concepts, you can explain so many things, and solve so many different problems in real life. In that sense, they are very economical; you don’t need to memorize lots of boring details of some chaotic practices and applications that might cost anyone many years of mental endurance and obedience in professional life.

I love fundamental theories in positive sciences like the Darwinian Evolution Theory, Game Theory, or Fourier’s Frequency Transformation. Once you have a solid understanding of such fundamental concepts, you can explain so many things, and solve so many different problems in real life. In that sense, they are very economical; you don’t need to memorize lots of boring details of some chaotic practices and applications that might cost anyone many years of mental endurance and obedience in professional life.

The simple performance fee calculation method which I want to introduce in this article is for me such a fundamental theory in a small scale. I’ve started with this relatively abstract backbone model and extended it easily to cover real life cases, like performance calculation with individual high water marks (HWM) for each shareholder. Because a backbone model must be simple and understandable, I will keep it simple in this article; at least simple enough for scientific minds (!).

The calculation method introduced here is simple primarily because it ignores inter-period cashflows, that is subscription and redemption transactions between the beginning and end of each performance measurement period. I will write about more complicated calculation methods with inter-period cashflows and shareholder equalization in my following related articles.

Why measure investment performance?

Investment performance, often measured as risk-adjusted returns, is a central key figure for all investment decisions. Investors and professional asset managers need to measure investment returns to monitor and adjust their investment decisions. Investment performance and attribution are also required to remunerate professional investment managers who take investment decisions for their clients.

Unlike asset based management fees that are often calculated as a fixed percentage of assets under management (AuM), performance fees are based on returns. Performance fees are often paid only if there is a positive performance, namely positive investment returns with respect to all given criteria like benchmark and hurdle rate.

The use of performance fees for the remuneration of investment manager is more widespread in the hedge fund business than in mutual funds. A base asset-based management fee plus a non-negative performance fee (for example 20% of fund’s realized gains) have become almost an industry standard for hedge funds.

The application of performance fees is a most controversial issue for mutual funds. Security Exchange Commission (SEC) of US requires that symmetrical performance fees should be raised for mutual funds which can be positive or negative. There are some other reasons –some rational, some irrational- why many fund managers are reluctant to apply performance fees. As a result, only a small minority of mutual funds use performance fees for the compensation of their portfolio managers.

Performance fee calculations are kept relatively simple for retail funds through regulations. They can but be quite complex for less regulated institutional funds.

Parameters of the simple performance method

Investment return is defined as percentage change of the value of an asset (or a fund’s share in our case) within a measurement period.

Investment return is defined as percentage change of the value of an asset (or a fund’s share in our case) within a measurement period.

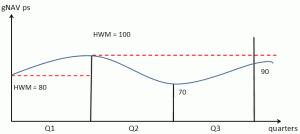

For example, if the NAV (Net Asset Value) per share of a fund increases from $80 to $100 in a quarter (like Q1 in the graph), the investment gain will be $20, and the investment return will be (100-80)/80 = 25% for this quarter.

Measurement period (or calculation period) is the chosen time interval for calculating investment performance. In most real-life cases, the measurement period is a year, but in our example as shown in the graph above it is a quarter (i.e. measurement frequency is quarterly), and the measured investment return of the first quarter is 25%.

Payment period can theoretically be different than the measurement period. For example, performance fees could be calculated quarterly, but paid out annually to the investment manager. In such a case, there would be performance fee accruals for each quarter until the actual payment date at the end of the calendar year. For the sake of simplicity I assume for this simple model that payment period is measurement period, so that we don’t need to care about accruals.

NAV period is related with the declaration of subscription and redemption prices. For example, “NAV frequency = weekly” means, NAV per share prices of the fund are published weekly. In most cases, NAV prices are published on a daily basis, and NAV frequency is also the trading frequency.

Outperformance is the relative investment return of an asset with respect to a benchmark which can be another comparable asset or an index. For example, if the investment return of a fund is 7%, and the benchmark return is 4%, the outperformance of the fund w.r.t. benchmark will be 3%. With outperformance as the reference value for remuneration, investment manager is required to beat the benchmark return to earn a positive performance fee. This can have advantages and disadvantages for the investment manager. Note that outperformance can be positive even if the fund’s return is negative; for example in a case where fund return = -3%, and the benchmark return = -5%.

Hurdle rate is the minimum rate of return the investment manager needs to achieve to earn a positive performance fee. For example, a performance fee will be paid only for the excess return 2% if the fund’s return is 7% with a hurdle rate of 5%.

If taken as a kind of relative return spread, hurdle rate integrates smoothly with outperformance (i.e. relative performance):

Excess Return = outperformance – hurdle rate = (fund return – benchmark return) – hurdle rate

… where the benchmark return can be taken as zero if there is no benchmark involved in the calculation.

High Watermark (HWM), the most cumbersome parameter of this simple model, is the maximum historical period-end NAV per share value. The HWM criterion is used to prevent the portfolio manager earn performance fees from poor past performance, or solely from the fluctuations in NAV. Ignoring other parameters like benchmark return, hurdle rate etc. that would clutter up the formula, performance fee with HWM could be simply formulated as follows:

Performance fee per share = Fee rate x max{0, (period end NAVps – HWM)}

As shown in the formula above, the period end NAV per share value must be higher than the current HWM value for a positive performance fee.

An example is shown in the graph on the left. There will be no positive performance fee for the third quarter Q3 even though there is a value appreciation from $70 to $90, because the period-end NAV per share value ($90) is lower than the current HWM ($100).

An example is shown in the graph on the left. There will be no positive performance fee for the third quarter Q3 even though there is a value appreciation from $70 to $90, because the period-end NAV per share value ($90) is lower than the current HWM ($100).

HWM condition is a kind of of carry-forward mechanism that adds much complexity and non-linearity to performance fee calculations, with unforeseeable incentive distortions. Losses are not charged instantly, but balanced indirectly by an equal portion of positive future performance. A simpler and better solution is in my opinion symmetrical performance fees without HWM condition (as SEC requires for mutual funds) which can be positive or negative, combined with a basis fee. Nevertheless, HWM condition is still an industry practice that needs to be integrated into calculation models.

Taken literally, the HWM feature doesn’t seem to integrate well with relative performance. It looks like an additional performance criterion which can either dominate or be dominated by the out-performance criterion, depending on the return values of the fund and the benchmark. For example, assume that the benchmark returns are always negative period after period. The performance calculation will then be dominated by the HWM condition. On the other hand, if the benchmark returns are consistently positive, the HWM criterion will be dominated by relative performance. All this adds more non-linearity and complexity to the behavior of performance measure.

As Einstein once said, everything is relative, even time! In analogy, even the HWM condition can also be defined in relative terms so that it works alright with relative performance.

Relative High Watermark (rHWM) can be defined as the maximum historical difference between the fund’s NAVps and the benchmark value (i.e. relative value), provided that benchmark value is identical to fund’s NAVps at the beginning. In other words, rHWM is the maximum historical relative value. Benchmark value is zero if a benchmark is not used in the calculation. Defined that way, rHWM becomes a more general condition covering also the special case of HWM without a benchmark.

The relative HWM is depicted in the graph at the left. In this example, there will be no positive performance fee in the third period because the current rHWM value 40 at the end of the third period is larger than the relative value 20.

The relative HWM is depicted in the graph at the left. In this example, there will be no positive performance fee in the third period because the current rHWM value 40 at the end of the third period is larger than the relative value 20.

HWM reset period indicates the time period(s) in which the relative HWM should be reset to zero. For example assuming that the calculation period is quarter, if HWM reset period = Q1 2010, the rHWM value should be reset to zero at the beginning of the first quarter in 2010.

The final parameters, performance fee floors and caps indicate the lower and higher limits on the performance fee paid to the investment manager. They could be formulated as excess return percentage, per share amounts or absolute payment amounts. For this simple calculation model I define them as per share amounts. For example, if cap is $1, investment manager gets maximum $1 per share as performance fee, whatever the excess return is. Floor can be set to zero to avoid negative (symmetrical) performance fees.

Putting everything together: The Calculation model

Assumptions:

- There are no inter-period share purchases (subscriptions) or sales (redemptions). All purchase or sale transactions occur at the beginning or end of the measurement periods.

- Measurement period is also the payment period; performance fee payments are done at the end of each measurement period.

- Measurement period can be a month, quarter, half-year or year.

- Benchmark returns are calculated elsewhere and delivered to the calculation model; the calculation model doesn’t need to calculate benchmark returns itself.

- The input parameter performance fee rate is stated with respect to the measurement period. For example, if the measurement period is a month, the given fee rate is a monthly rate; not an annual fee rate.

Input parameters:

- NAV per share (NAVps) values of the fund for each period

- Performance fee rate; a percentage like 20%

- Benchmark returns for each period; benchmark return is zero if there is no benchmark for the calculation.

- Hurdle rate; a percentage like 3%

- Relative High Watermark (rHWM) condition: Yes or No; if yes, apply rHWM condition for calculating performance fees.

- Fee floor and cap, indicated as per share dollar amounts.

Results (outputs):

- Fund return

- rHWM values

- Outperformance

- Benchmark value

- Relative value

- Excess return

- Fee before cap & floor

- Performance fee per share (final result)

You can find the formulas and other calculation details in the supplementary PowerPoint slides, and in matlab or R files that can be downloaded from the download page.

The calculation of excess return (outperformance – hurdle rate) is quite straightforward. The less trivial part may be the relative HWM. There are three possible cases related with the relative HWM condition:

- Apply rHWM condition (yes to rHWM), relative value is larger than current rHWM (i.e. rHWM test passed): The final performance fee will be determined by the excess return and cap/floor amounts. To calculate the effective outperformance with rHWM, outperformance is scaled by the proportion of “relative value above rHWM” to “relative value appreciation w.r.t. previous period” (see related formula in downloadable PowerPoint slides and matlab script). Hurdle rate is then substracted from this effective outperformance to obtain the excess return.

- Apply rHWM condition (yes to rHWM), relative value is equal to or less than current rHWM (rHWM condition is not passed): The final performance fee will be depend on hurdle rate and floor. The performance fee cannot be negative unless there is a hurdle rate to overcome.

- Don’t apply rHWM condition (no to rHWM): The final performance fee will be determined by the excess return and cap/floor amounts. Performance fee can also be negative without a positive floor value.

I plan to show this simple performance fee model in action in the following related article. Please don’t hesitate to send any questions or comments.

Tunç Ali Kütükçüoglu, 27. March 2012

Supplementary PowerPoint slides including formulas and other calculation details as well as matlab and R files to test the simple performance feecalculation can be downloaded from the download page.

Related content

Recommended resources

- Performance Fees – Good or Bad?

- Google for “Your guide to performance fees” from insightinvestment.com (pdf file)

- Performance fee – Wikipedia

- Hedge fund – Wikipedia

Copyright secured by Digiprove © 2012 Tunc Ali Kütükcüoglu

Copyright secured by Digiprove © 2012 Tunc Ali Kütükcüoglu

Hi Tunc – seriously great post….

It strikes me that in the simple model, as there are to be no subs/reds within a measurement period, the measurement period must be given by the NAV Period. I.e. if one’s dealing/trading day is a Friday (and thus that is when a new NAV is published), then the measurement period has to be fri-thurs. In other words, one does not *select* the measurement period – it must be inferred (from the NAV period).

Do you agree?

Thank you,

Tamim.

Yes, you are right. This is the first assumption of this simple performance model:

There are no inter-period share purchases (subscriptions) or sales (redemptions). All purchase or sale transactions occur at the beginning or end of the measurement periods.